Noi margin formula

Potential rental income 800. NOI can also be expressed as a percentage of total revenue which is how hotel management can easily identify upward and downward trends in profitability.

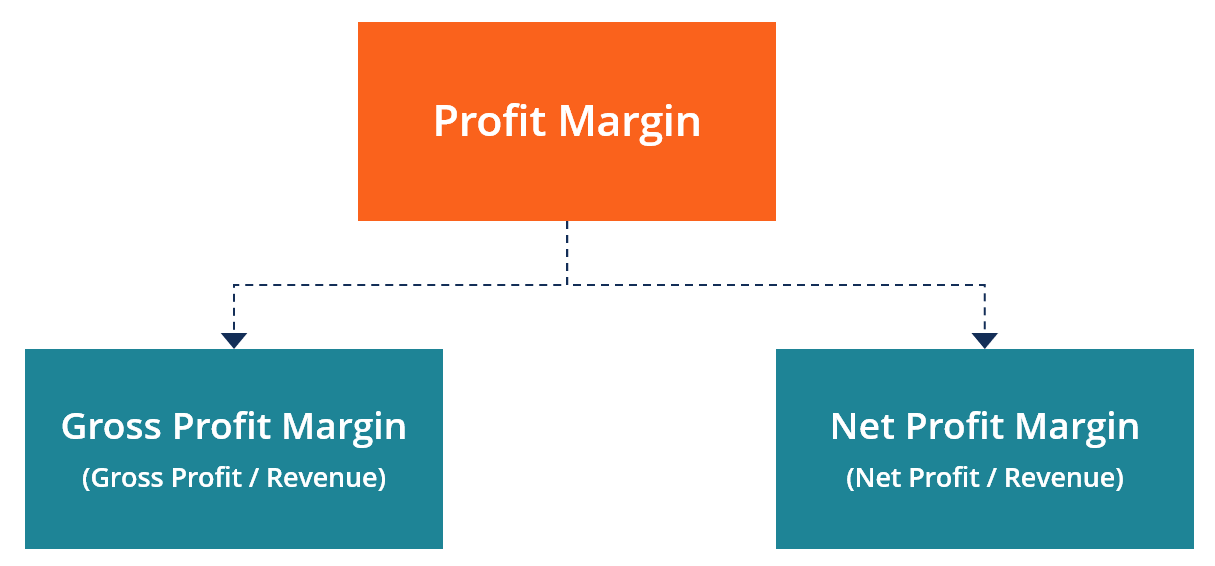

How Do Gross Profit Margin And Operating Profit Margin Differ

When the result is.

. Property Value NOI Cap Rate. What is the formula for Noi. The gross margin is derived by the deducing Cost of Goods Sold COGS from the net revenue or net sales gross sale reduced by discounts returns and price adjustments.

To find the value of NOI use the following formula. Examples of NOI Margin in a sentence Core NOI Margin is. For example operating margin which is the potential rental income divided by NOI can be directly compared across similar properties.

The formula for calculating NOI is as follows. The operating profit would be Gross profit Labour expenses General and Administration. NOI real estate revenue operating expenses.

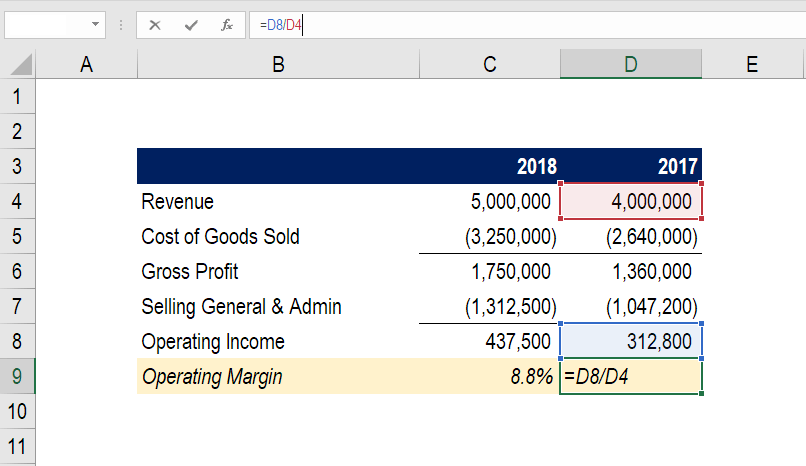

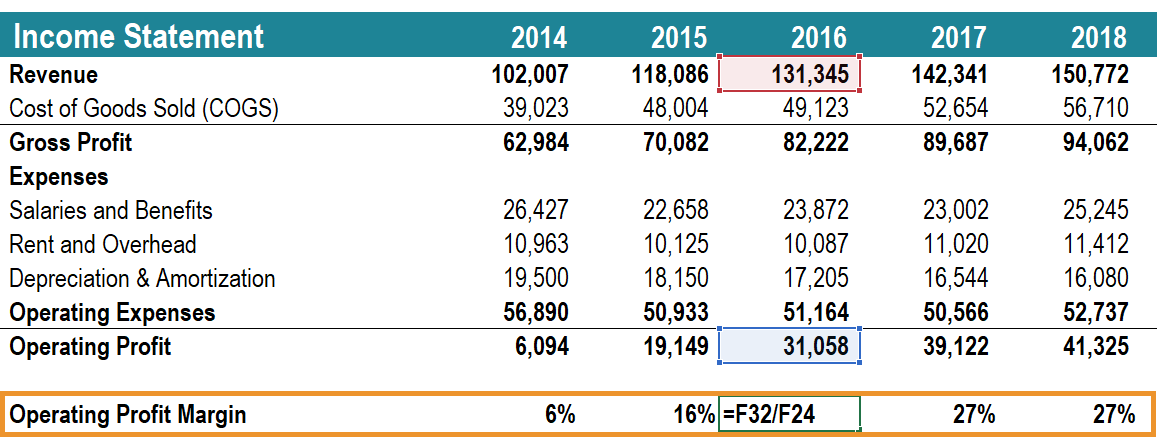

Now we will deduct the operating expenses from gross profit to determine the operating profit. Calculating NOI involves subtracting operating expenses from a propertys revenues. Net profit margin is the ratio of net profits to revenues for a company or business segment.

Its important to compare a propertys NOI. Examples of NOI Margin in a sentence. In that case the.

Given the property-specific nature of NOI it is usually used to measure the profitability of a property whether it be commercial or. Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and. Typically expressed as a percentage net profit margins show how much of each.

The formula for calculating NOI is as follows. Given the property-specific nature of NOI it is usually used to measure the. The major difference is the use-case of each metric.

To find the value of NOI use the following formula. Calculating EBIT uses the same equation but depreciation and. Looking at their portfolio valuation by Cushman Wakefield 3rd party appraiser the only way I could arrive at the property value calculated for that property is to assume NOI.

Public NOI Margin Stability and Growth in Mature Markets In certain developed markets such as the UK and the US early stage development of the sector. Cap rate or capitalization rate is used to estimate the return on investment for a cash. By plugging the above income and expenses number into the NOI formula we can determine the propertys expected annual net operating income.

Operating Margin What It Is And The Formula For Calculating It With Examples

A Possible Framework For Analysis Mgt232 Lecture In Hindi Urdu 23 Youtube Financial Statement Analysis Analysis Analytical Framework

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Net Profit Margin Formula And Ratio Calculator

Average Restaurant Profit Margin And Restaurant Operating Expenses Brandongaille Com Restaurant Management Restaurant Names Restaurant Marketing

Operating Margin An Important Measure Of Profitability For A Business

Operating Profit Margin Formula Calculator Excel Template

Profit Margin Guide Examples How To Calculate Profit Margins

3

Operating Profit Formula

Contribution

Understanding Operating Margin

Operating Margin Formula And Calculator

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And Traditional Income Statement I Felt Like You Can Easily S

Operating Profit Margin Learn To Calculate Operating Profit Margin

Contribution Margin Ratio Formula Per Unit Example Calculation

1